stock market correction coming 2020

The Motley Fool. COVID-19 could also have a big impact over how a future correction will play out.

2020 Crash Compared With 1929 1987 2000 And 2008 2009 Nysearca Spy Seeking Alpha

And in 2020 the RSI indicator was.

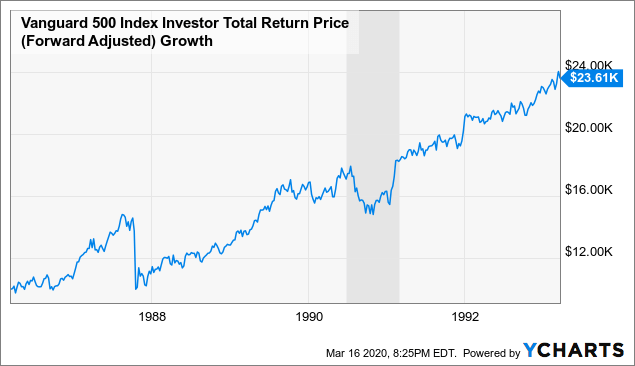

. The high was a 127 return in April 2020 and the low was a. A market correction is a brief downturn in the market as a whole or in the price of a particular asset that usually is somewhere within the range of 10-20 of the most recent peak. Stock indexes typically the SP 500 or Dow Jones Industrial Average from a recent 52-week high close.

Prior to opening the Dow Jones Industrial Average futures market experienced a 1300-point drop based on the coronavirus and fall in the oil price described above triggering a trading curb or circuit breaker that caused the futures market to suspend trading for 15 minutes. The last time we saw a stock market correction was in March 2020 when the overall market SP500 dropped 35 from its most recent high. Why this top strategist is concerned about a stock market correction coming within months.

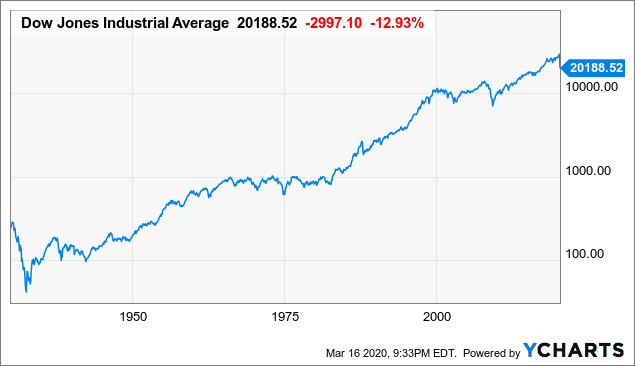

Monday December 30 2019. A correction is defined as a 10 decline in one of the major US. In 2001 the RSI indicator was resting at 69 the Nasdaq later collapsed 44 in the following months.

The stock market quickly bounced back from the COVID-19 driven decline in early 2020 and has topped new records raising concerns over a potential stock market bubble. When the stock market stumbled earlier this week you may have been spooked and understandably so. The SP 500 SPY has had a record-setting year.

The Risk Of A Market Correction In 2020 Hits New Highs. This signal is worrisome considering that RSI has accurately predicted Market CrashesCorrections dating back to 2001. The term correction refers to the fact stocks are being.

This calculates to a ratio of 146 which values the stock market at significantly overvalued. The Buffet Indicator has shown the market as overvalued since. Sean Williams has no position in any of the stocks mentioned.

Stock indexes have all. Predicting when a correction is coming can be very challenging although that doesnt stop people from trying. Given that an individual stock can decline due to factors not indicative of the market as a whole a correction generally applies to a major stock index such as the SP 500.

As we roll into June the major US. It means your expected return is significantly negative over some relevant period in the future and. As of February 28 2020 the entire value of the stock market was 3174 trillion with GDP at 2173 trillion.

We will likely witness a substantial stock market correction of. Forecasting a correction means you have high conviction in a material decline in stock prices. Shares fell about 1 from Sept.

All major car companies are introducing new. McDonalds is another stock that didnt flinch during the latest stock market correction. A Few Red Flags That Signal A Stock Market Correction Is Coming.

Which shut down businesses all over the world increased quarantine restrictions and saw mass effects on single companies. The SPY ETF then lost 3849 of its value. To some extent investors do some amount of timing either passively or actively.

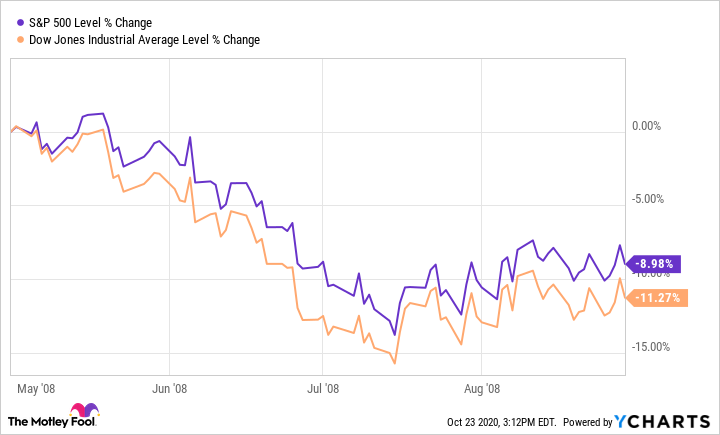

Correction does not mean returns are likely to be modest or things are getting riskier and volatility is likely to be higher. 7 before bottoming and going on a solid rally. In 2008 the RSI indicator was valued at 72.

They usually last for a very short period of a day or two. This 5595 million fund is positioned for electric car growth no matter if theres a market correction. The market dip which was attributed to investors concerns about the high debt levels of one of Chinas largest real estate developers was hard to stomach given the resilient bull market weve seen over the past year with the SP 500 up 100 last month.

Chart showing the level of GDP and total market value as of 02282020. Although a correction or crash may be inevitable thats no reason to deviate from a successful buy-and-hold strategy. 21 hours agoNew York CNN Business US stocks have plunged into a bear market as Wall Street investors grew increasingly nervous about the prospect of even harsher medicine from the Fed to take the sting out.

Is a market correction coming in 2022. Much of the gains have come in the second half the index has posted five straight weeks of gains. If youre feeling anxious that the stock market is headed for a correction in the.

Ultimately September 2020 registered a 39 decline for the SP 500 coming after five straight months of sharp gains in the aftermath of the COVID-19. That time around it was induced by a globally devastating event COVID-19. Answer 1 of 5.

A stock market correction is coming. Some examples are buying perceived undervalued stock or selling overvalued stock selling covered calls as an exit strategy selling cash secured. Historical analysis shows.

Simply put a stock market correction is generally seen as a decline of at least 10 but less than 20. After falling -35 in 2018 -185 from the 2018 highs the broad-market index has surged nearly 30 this year. Over the previous weekend on 8 March the TA-35 and TA-125 Indices of the Tel Aviv Stock Exchange fell by 45.

Stock market closed out May mostly unchanged from where it began a feat made possible only due to a strong month-end surge.

Will The Stock Market Go Up Or Crash In 2022 What Top Forecast Models Predict Fortune

2020 Is Coming To An End In The Markets And It Is Time To Conclude Stock Market Technical Analysis Stock Market Marketing

Dow Drops 1 100 Points For Its Biggest Decline Since 2020 As The Sell Off This Year On Wall Street Intensifies

2020 Crash Compared With 1929 1987 2000 And 2008 2009 Nysearca Spy Seeking Alpha

Stock Market S Covid Pattern Faster Recovery From Each Panic The New York Times

Indu Ym F Elliott Wave Forecasting The Path Waves Forecast Elliott

Trading Lesson Marche Boursier Trading Boursier

Stock Market Correction Probability And Statistics Stock Market Stock Market Crash Marketing

Bitcoin We Maintain The Same Outlook Bitcoin Social Security Card Cryptocurrency

Large Cap Growth Stocks As Represented By The Russell 1000 Growth Index Have Climbed 122 Since The Market Low In March Stock Market Investing Learning Centers

Tesla Tsla Providing The Floor In The Stock Market Stock Market Tesla Analysis

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments Interest Rate Chart Interest Rates Financial Wealth

Nifty Technical Analysis Technical Analysis Future Options Stock Market Index

No This Isn T A Repeat Of The Dot Com Bubble Of Dollars And Data Dots Tech Stocks Equity Market

Market Cycles Phases Stages And Common Characteristics Trading Charts Marketing Fundamental Analysis

Us Dollar Projected To Hit Cyclical Bottom In 2025 What Does It Mean For Bitcoin Us Dollar Index Bitcoin Bitcoin Market

What Are Stock Market Corrections The Motley Fool

Aggressivetrading Wave Theory Stock Trading Strategies Stock Market